Who Wins as Enterprises Scale AI?

Vista’s View: Enterprise Software Solutions Are Here to Stay

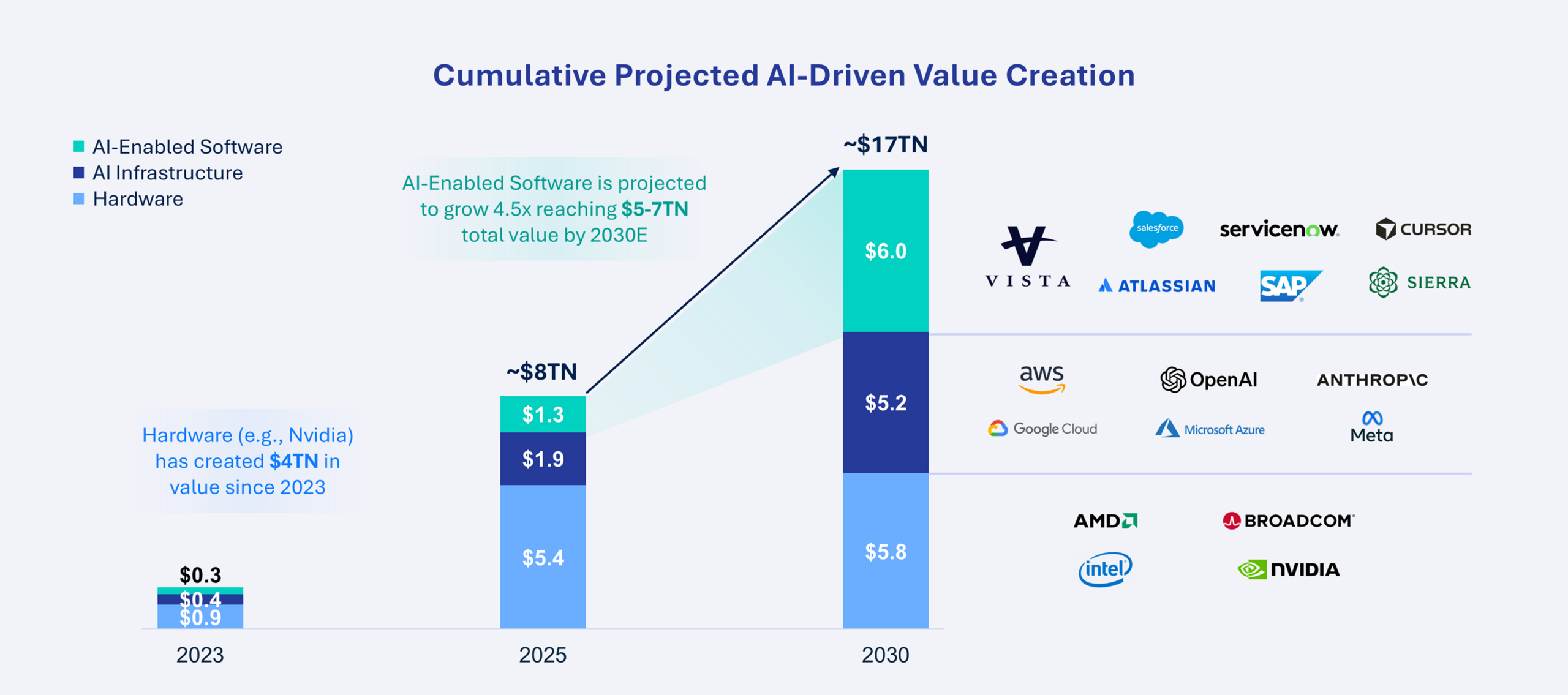

Leading corporations are moving from AI experimentation to implementation, with AI-enabled applications and software creating approximately $1 trillion in value from 2023 to 2025 and projected to grow another 4.5 times by 2030.1

At the same time, investors are questioning: if AI makes it dramatically easier to build software and automate work, does enterprise software become less attractive or even obsolete?

We believe that AI will not eliminate the need for software platforms. Instead, it may increase the value of certain incumbent systems. As AI evolves and moves closer to executing work (versus advising it), core attributes of enterprise software companies, including reliability, workflow sovereignty and IP, and proprietary data, become even more valuable to enterprise customers.

The resulting outcome is likely not a zero-sum contest between leading LLMs, incumbents and AI-native startups, nor do we expect a wholesale shift from buying software to building it internally.

An Overall Growing Pie, Not a Zero-Sum Contest

History shows that as technology becomes more abstract (for example from on-prem to cloud, from cloud to low-code), software demand expands rather than contracts. We believe AI may follow the same pattern.

Despite rapid growth, current enterprise AI spending remains narrowly concentrated on a small subset of workflows. As illustrated in the chart, bottoms-up analysis from Bain & Company suggests an addressable opportunity of approximately $5 – 7 trillion in value creation for AI-enabled software by 2030.2

The gap between today and the future opportunity largely reflects transformation in labor market structure that may play out over a multi-year transition cycle. As AI systems evolve from supporting work to executing it, we believe the opportunity set could expand beyond traditional IT budgets and into labor-intensive workflows across functions such as customer support, finance, HR and operations. In that sense, we believe the long-term opportunity could be not merely a cycle of AI replacing software, but instead could be a reallocation of economic activity from labor and services to software, potentially materially expanding the total addressable market rather than reshuffling it.

Potential TAM Expansion for AI and Software is Profound 3

Enterprise Software’s Growing Incumbency Moat

As AI systems move from assisting users with content creation (GenAI) to executing work (Agentic AI), we observe three key advantages of incumbency:

1. Reliability and Accountability: Business Use Cases Demand Precision

While AI models are probabilistic (dealing in likelihoods), the corporate world is deterministic (requiring precision). A business cannot function on “mostly correct” payroll or “likely” regulatory compliance. Incumbent software vendors have spent decades building the necessary infrastructure — audit trails, explainability, reproducibility, etc. — that can turn AI into a usable, low-risk business tool.

Announcements like Anthropic’s release of Claude CoWork highlight great potential, but the trust gap for corporations is immense, a sentiment that was echoed by PwC’s survey of 300 senior executives who identified a lack of trust in agents’ abilities to execute tasks.4

An illustration of this dynamic is Duck Creek Technologies in property and casualty insurance,5 a domain where AI outputs must be deterministic, explainable and auditable. In insurance, decisions around underwriting, loss control, and claims cannot drift — every outcome must trace back to regulatory rules, policy language and historical loss data. Duck Creek is in the process of launching standalone Agentic AI products that allow the largest and most sophisticated insurance customers to build their own AI-driven workflows while relying on Duck Creek AI Agents for the most risk-sensitive components.

2. Ownership of Mission-Critical Workflows:

Successful enterprise AI applications require deeply detailed workflows. As Satya Nadella noted at the 2026 World Economic Forum, firm-level sovereignty and the ability for a company to control and embed its proprietary knowledge into AI models is likely to become one of the most discussed issues in AI this year. We see the protection of workflow IP as foundational to the success of software companies.

While AI lowers the cost of writing code, it does not lower the cost of defining, testing and maintaining workflows. This challenge is why many successful software businesses focus on workflows in specific industries, where the solution is developed for a unique business process and can account for real-life edge cases that can take years to document and solve appropriately.

In our view, AI solutions that lack this embedded context (like general-purpose LLMs) may struggle to assume responsibility for execution. We believe this can serve as a defensible moat for incumbents, and may also provide them with an edge. In our opinion, incumbents have a head start on unlocking value through AI execution capabilities because of their ownership and understanding of workflows.

ServiceNow’s partnership with OpenAI illustrates why control of enterprise workflows is emerging as a decisive advantage in the Agentic AI era.6 Announced in January 2026, the multi-year agreement embeds OpenAI’s advanced models directly into the ServiceNow platform, enabling AI agents to act within live IT, HR and service processes rather than operating as standalone tools. For OpenAI, the partnership provides access to governed enterprise environments where permissions, compliance requirements and execution logic are already in place. For ServiceNow, it reinforces its position as a system through which AI is safely deployed, orchestrated and monetized. The partnership is part of a trend we expect will continue, where AI is embedded in incumbents that possess sovereignty over a corporation’s workflows.

3. Proprietary Data with Context

Incumbents control large volumes of proprietary, structured data generated through decades of use. The enterprise data itself, which is generally not available today to LLMs an asset that gives incumbents an edge in building domain specific intelligence.

Value also lies in the context attached to that data. For example, enterprise software data defines what constitutes a valid transaction, a compliant outcome or an exception that requires intervention. As AI systems act autonomously, this context becomes essential to deliver consistent and reliable results.

Why Vista Believes Enterprises Are Likely to Still Buy, Not Build

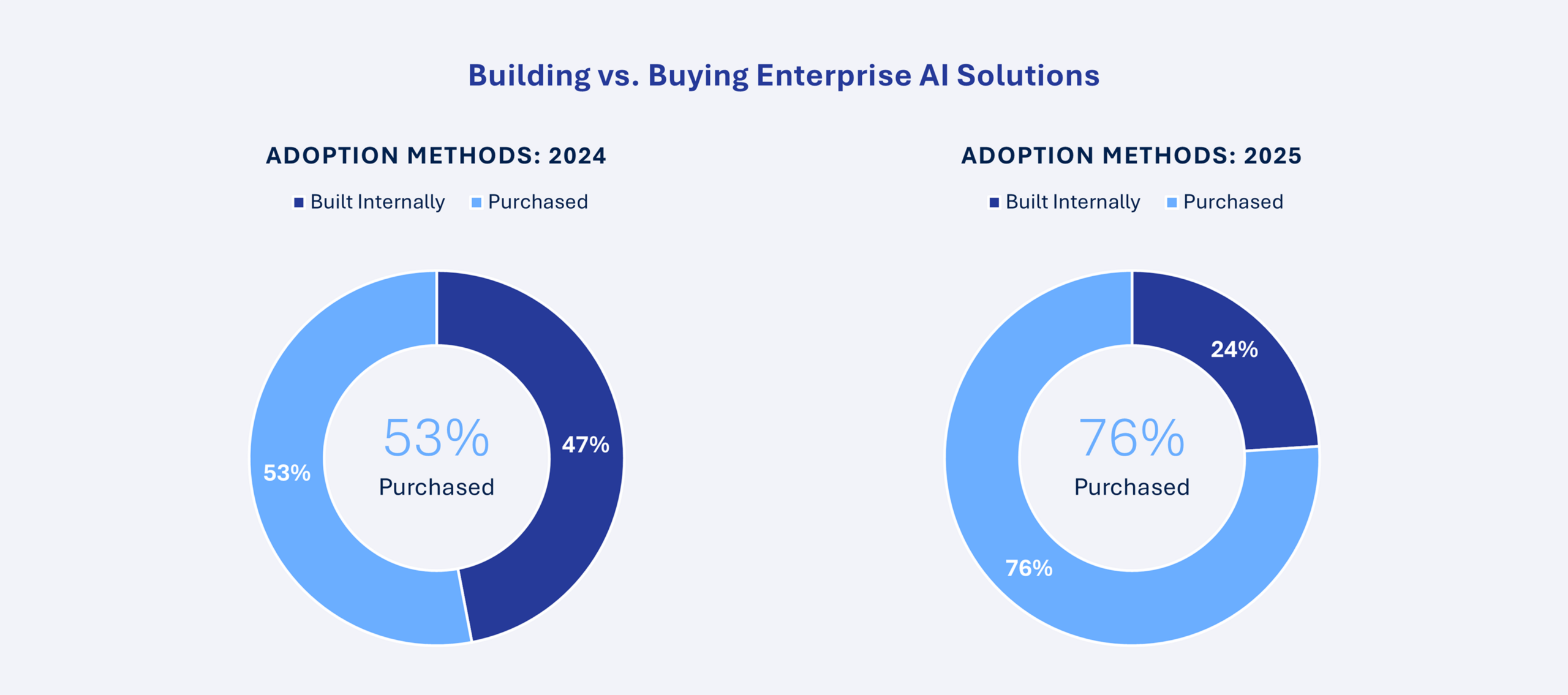

As AI lowers the cost of building software, there is a belief that enterprises will increasingly build rather than buy.

AI changes how software is built, but it does not change who bears responsibility. Reliability, governance and ongoing accountability of the solution again remain the dominant decision criteria for enterprise IT departments.

For most enterprises, these requirements favor vendors.

Large organizations may selectively build AI agents around proprietary cases where they have true differentiation. However, few will attempt to build and maintain horizontal platforms, core systems of record or mission-critical execution layers. These systems demand investments in security, compliance, uptime, LLM model monitoring and regulatory adaptation — costs that compound over time and scale poorly inside most IT organizations.

Early IT department trends show that most companies plan to continue their partnerships with third-party platforms for AI solutions, in addition to exploring hybrid solutions. In short, AI expands the design space for enterprises, but it does not change the reality that internal systems must be reliable, tightly governed and maintained.

The Share of Enterprise AI Solutions Being Purchased vs. Built Internally Is Increasing7

Understanding AI-Native Growth and Strengths in a Growing Market

AI start-ups can be framed as disruptors of incumbent enterprise software, but the revenue data so far tells a different story. Monetization remains highly concentrated in a small number of newly created categories with OpenAI and Anthropic alone accounting for nearly 85% of all annualized revenue generated by AI-native companies.8 This concentration underscores that AI-native growth to date is driven by foundational intelligence and a handful of emergent application categories, not widespread replacement of incumbent systems.

We place AI-native opportunities across three categories, with foundational model providers representing a distinct category. Like prior cycles, we expect some companies will scale independently, while others will partner with established enterprise systems or be acquired.

1. Foundational model providers in a class of their own

Foundational LLM providers such as OpenAI and Anthropic occupy a distinct position as default suppliers of intelligence. Much like cloud infrastructure provided by companies like Amazon and Google in the prior transformation cycle to the cloud, they have the potential to support a wide range of applications. These platforms can serve as critical enablers for enterprise software but are unlikely to serve as direct substitutes for horizontal or vertical enterprise systems.

2. AI point-to-point solutions

A second category consists of products targeting discrete workflows that were previously impractical. Companies like Glean and Perplexity serving research, analysis, customer interaction, and content generation, are demonstrating early product-market fit. Code-generation tools such as GitHub Copilot and Cursor similarly compress development cycles by translating intent directly into functional software. Their success reflects AI’s ability to unlock entirely new categories of work, even as they often rely on incumbent systems for data access, execution, and integration.

3. Vertical AI intelligence products

The third category includes AI-native companies building domain-specific intelligence in regulated or high-stakes industries. Companies such as Harvey in legal services and Hippocratic AI in healthcare are training models around the language, constraints, and professional standards of their respective domains. While these vertical intelligence providers are unlikely to replace systems of record, they illustrate how intelligence specialization has the possibility of reasoning sharper than general-purpose platforms for their enterprise customers.

Operational Intelligence at Scale

Vista’s edge in the Agentic AI transition comes from decades spent operating alongside enterprise software companies and their customers through massive technological shifts.

With a portfolio of more than 90 software businesses serving millions of end users, Vista is rapidly deploying AI learnings across these businesses to build and deploy AI agents inside incumbent systems of record. Our scale and operating depth provide unique access to strategic partnerships, including working directly with leading hyperscalers like Google.

More than 30 of Vista’s portfolio companies have already released AI agents,9 and with each new product launch, we believe we are building a compounding advantage in helping our companies capitalize on the agentic future.

Rethinking Software Benchmarks in an AI-Driven Market

AI Investment Landscape Primer