AI Investment Landscape Primer

Understanding the Ecosystem, the Opportunity and the Path to Value

Artificial intelligence (AI) has arrived and invigorated investment markets. Like electricity and the internet before it, AI is not a single innovation but an enabling force driving a new economic era.

For investors, AI represents both a generational opportunity and a complex challenge. Its rapid evolution is redefining business models and capital flows. Yet for all the excitement, it remains difficult to determine where value will ultimately accrue and how to build risk-adjusted exposure to this technology.

Key Takeaways

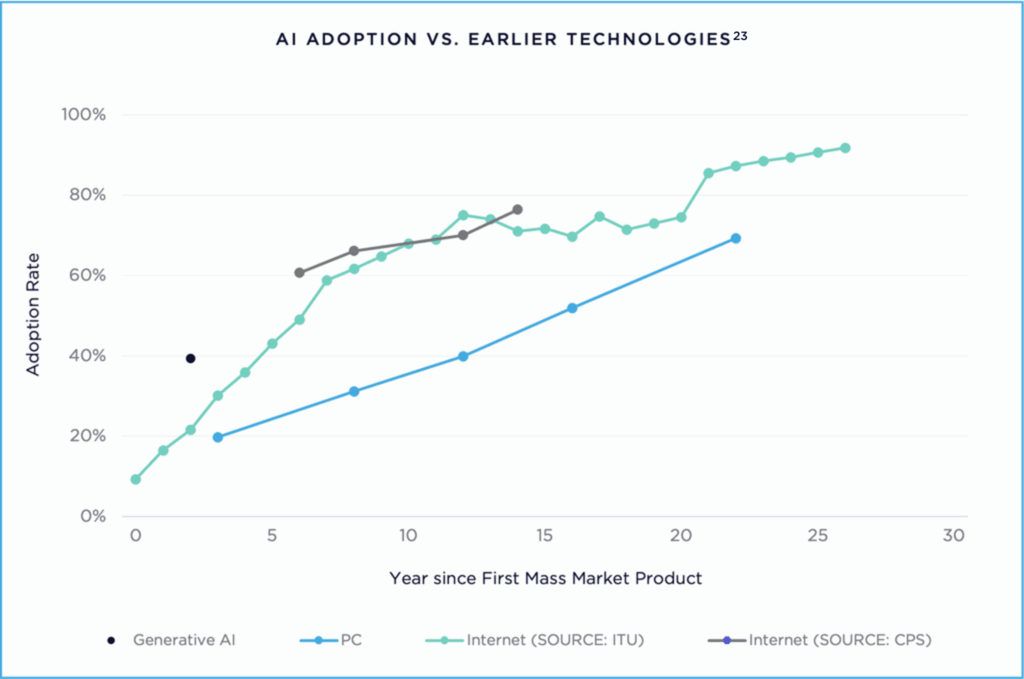

- AI represents a once-in-a-generation investment opportunity: The pace of adoption across consumers and enterprises is faster than any previous technology shift.

- Value in AI accrues across interconnected layers: The AI ecosystem spans hardware, AI infrastructure and data centers, energy, foundational models, cloud and delivery platforms, data and AI applications and software. Understanding these layers is essential to identifying where value is created and sustained.

- The AI application and software layer is emerging as a key pillar in the AI economy: With proprietary data, direct customer relationships and measurable productivity impact, software companies are positioned to convert AI innovation into enduring enterprise value.

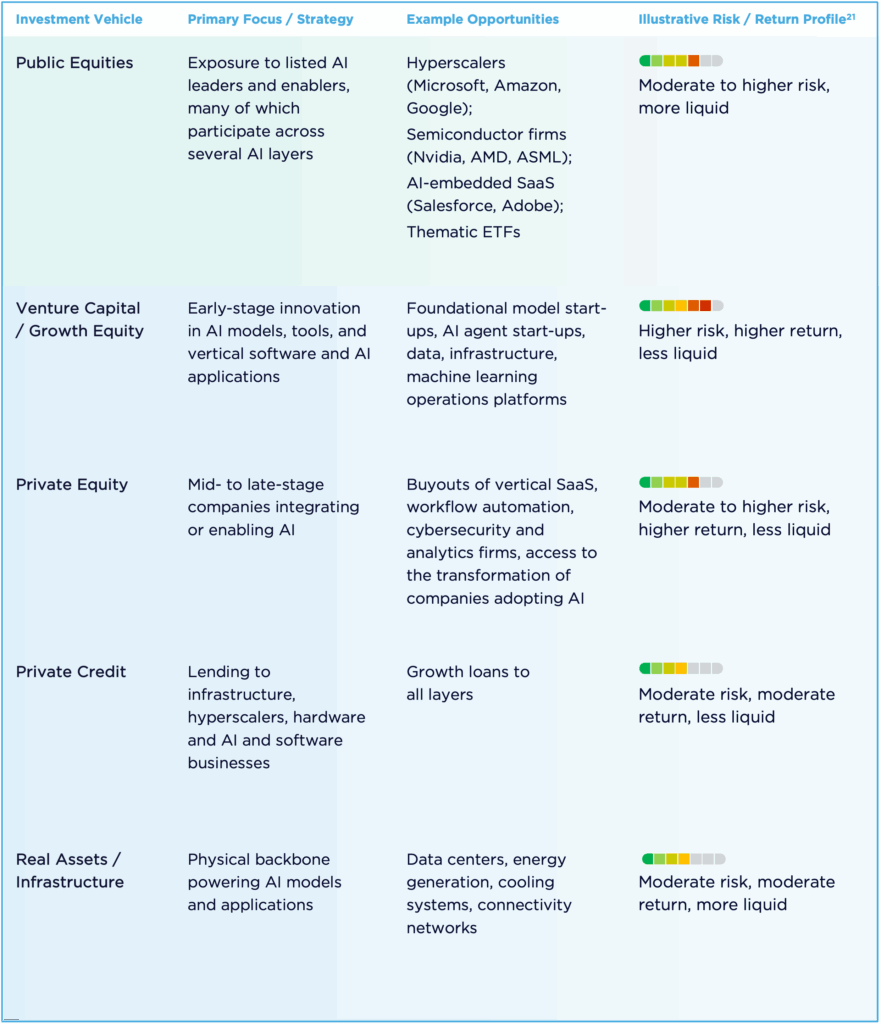

- Public markets offer scale and accessibility, but private markets offer alpha: Public equities – particularly large-cap technology and infrastructure leaders – represent the most direct and diversified way to access AI exposure. However, these markets are already crowded with capital. In contrast, private markets offer greater opportunity for differentiated returns and active value creation.

- Private equity and private credit offer distinct pathways to participate: Private equity offers investors a pathway to invest in smaller, high-growth companies and the potential to generate alpha relative to public-market peers. Private credit provides income-oriented participation with lower volatility and attractive downside protection.

- Portfolio construction depends on risk appetite and access: While public markets provide exposure to established leaders, we believe there are compelling opportunities in the private markets.

What Is the AI Ecosystem

Thinking in Layers and Waves

Understanding AI as an investment opportunity begins with recognizing its structure. AI is not a single industry; it is a connected ecosystem built across layers of technology and waves of value creation.

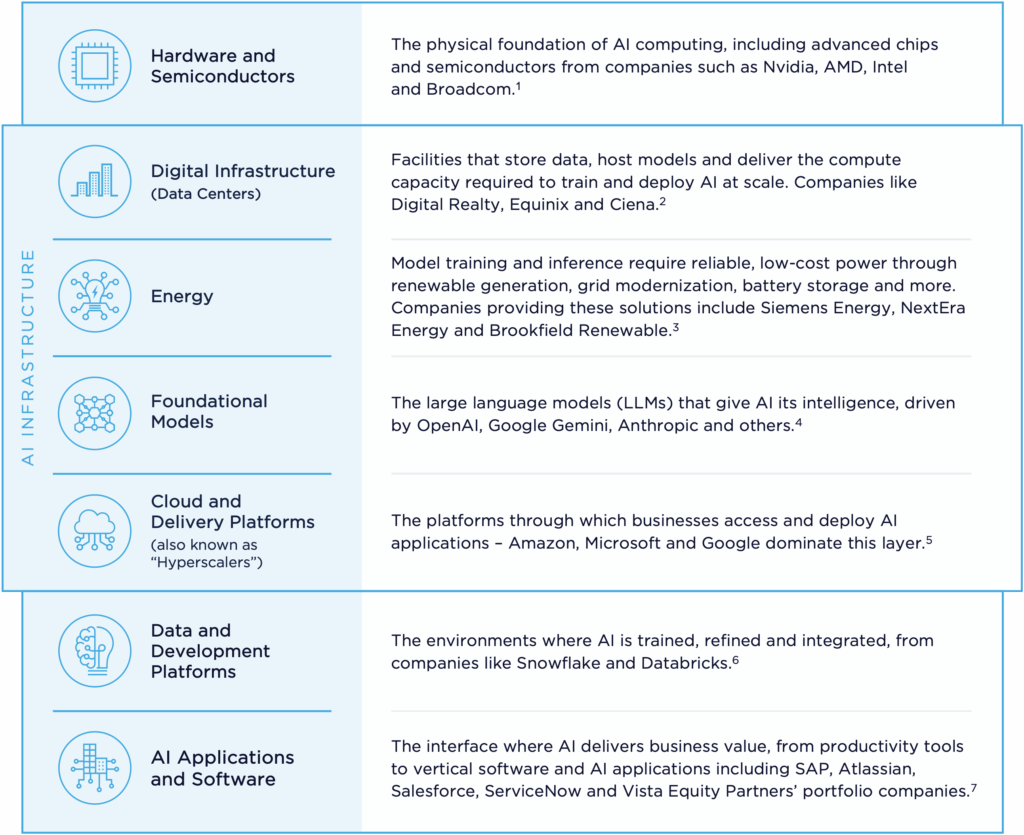

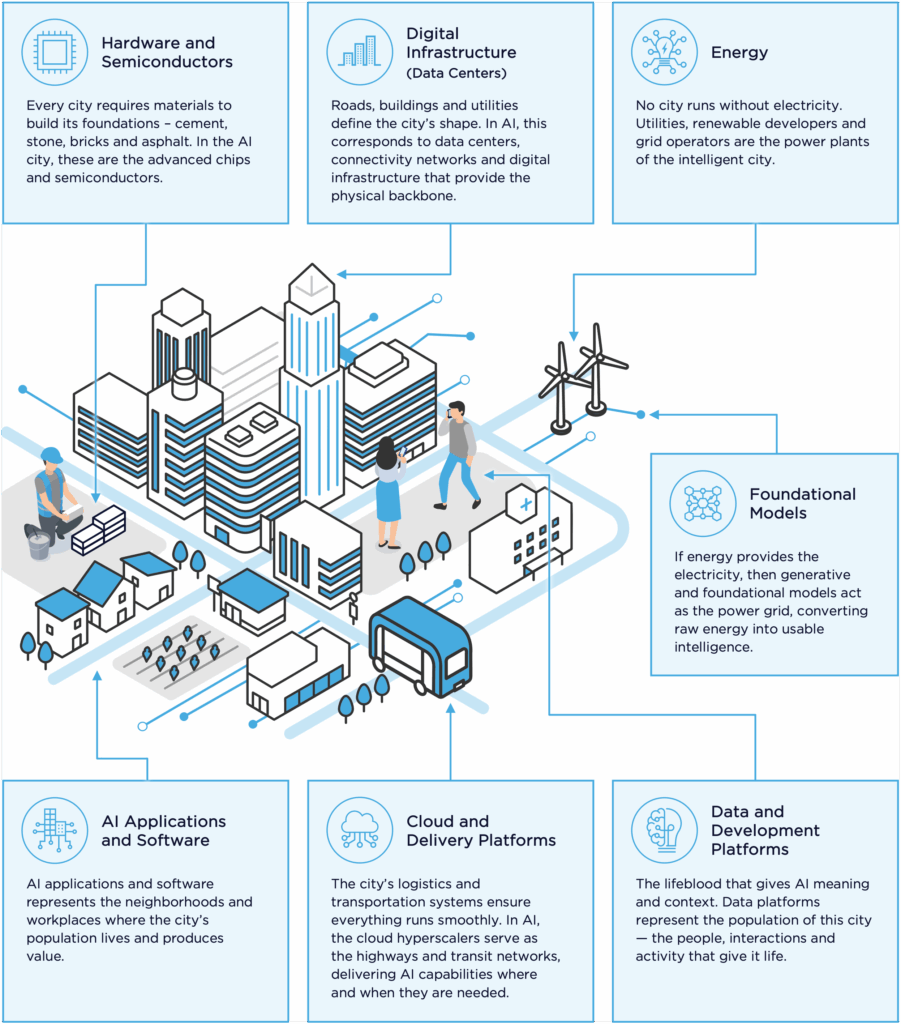

Layers represent the market segments that make AI possible:

The Intelligent City: A Metaphor for AI

To visualize how these layers interact, imagine AI as a modern city where each element depends on the others to function.

Waves

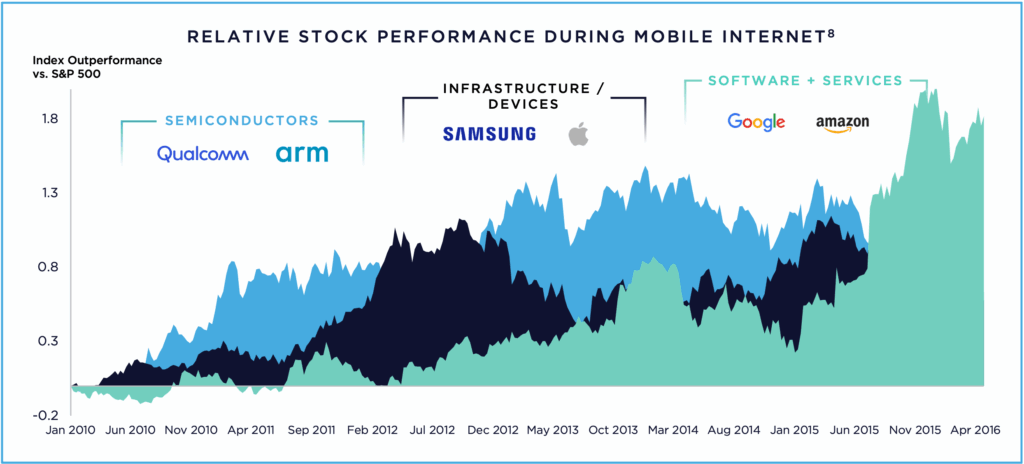

As with prior major technological shifts, we expect value creation from AI to occur in waves, with various layers described above benefitting at different points throughout the innovation cycle. A historical parallel is the creation of the internet, when value was first concentrated in semiconductors, then moved to infrastructure and devices, and finally to software and services.

As Mark Twain said, “History doesn’t repeat itself, but it often rhymes.” We hypothesize that a similar pattern could emerge with AI, where value creation will move from hardware to infrastructure to software and AI applications. That said, with the pace of AI evolution it is possible that new layers of value creation may emerge.

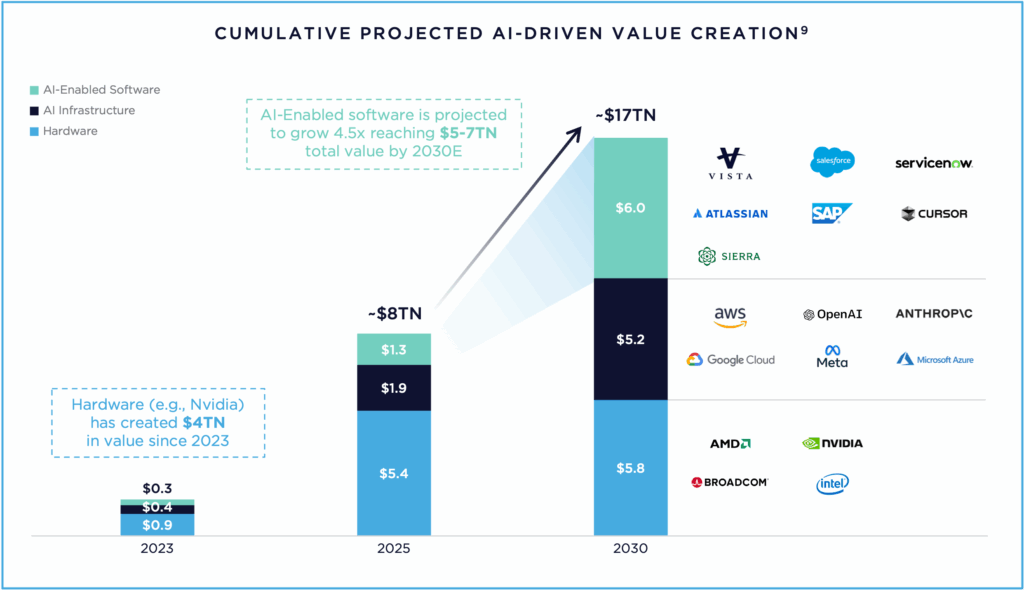

As estimated by Bain, approximately $8.2 trillion in value has already been created, as measured by the market capitalization or private valuations across a basket of companies that lead with an AI-first strategy, develop core AI tools or provide essential AI infrastructure.10

- We are currently experiencing the hardware wave. The AI revolution runs on compute, at exponentially greater processing power. As such, the hardware layer has accrued the most significant share of total value. Nvidia alone represents over half of the value created in 2025. Since January 2023, the company’s market cap has grown from $400 billion to over $5 trillion.11

- The AI infrastructure wave is gaining momentum, driven by the foundational models and hyperscaler platforms which make AI models and capacity widely available to enterprises and consumers. Underlying this wave is massive investments in data centers and related infrastructure to meet expected demand. OpenAI alone has signed more than $1.4 trillion of infrastructure deals in 2025 to build out the data centers it needs to meet demand.12

We believe the AI applications and software wave could be the ultimate destination for value creation, as it is the bridge between the power of AI and its practical adoption in the world and the business environment.

Think Waves To Form Your Investment View

Forming your investment view requires understanding where value has already accrued and where future value will likely accrue across the layers.

- Hardware has been the foundation of AI value creation. Explosive demand for GPUs and advanced semiconductors has driven extraordinary pricing power for leaders like Nvidia and AMD. The bull case rests on continued model complexity and global compute expansion. Yet this wave may be approaching maturity. Market concentration is high and valuations are stretched. Advances in model efficiency may reduce incremental hardware demand, suggesting a shift from exponential to more normalized growth.

- AI infrastructure remains a long-term growth engine. Continued demand for compute, storage and energy supports a strong case for sustained investment. The key risks are commoditization and high capital intensity. Hardware and model evolution could shorten asset life cycles, while future models and applications may require less compute to deliver similar outcomes. Infrastructure offers durable growth potential, but success will depend on disciplined capital deployment and technological adaptability.

- AI applications and software represent AI’s most dynamic frontier. The bull case lies in accelerating enterprise adoption and expanding addressable markets. Incumbent software companies that successfully integrate AI into workflows can unlock measurable ROI and recurring revenues, and that value creation should flow to the providers of the AI solutions. The challenge is that many AI-native start-ups operate at negative gross margins and rely on continual funding, while incumbents must adapt quickly to defend market share from both AI-native start-ups and LLMs themselves. The long-term winners will be those able to build sustainable, scalable economics.

Evaluating Investment Opportunities

Public Markets Concentration: What the MAG Seven Reveal

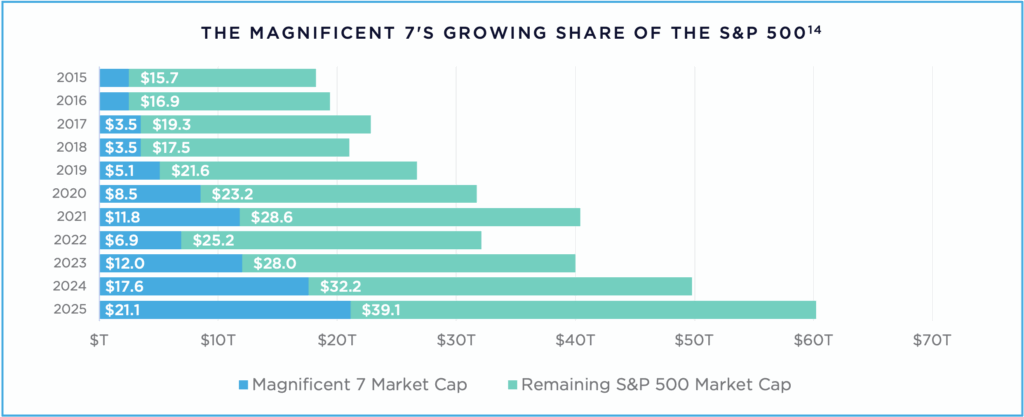

In public markets, the “Magnificent Seven” — Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta and Tesla — now represent roughly 30 to 32 percent of the S&P 500’s total market capitalization.13 This dominance underscores where investor conviction and liquidity have gathered. Nvidia powers the hardware layer, Microsoft, Amazon and Google anchor cloud infrastructure and applications.

The implication is twofold:

- AI exposure across many of the ecosystem layers is already embedded in major public-market equity benchmarks. Investors holding large equity portfolios are effectively invested in AI through the largest technology giants.

- Market breadth is narrowing. Capital is consolidating around a handful of AI-aligned firms with scale advantages in data, compute and distribution.

For investors and financial advisors, this concentration highlights both opportunity and risk: while mega-cap performance continues to shape overall market returns, diversification beyond these leaders – particularly in private markets and infrastructure vehicles – offers differentiated entry points into the broader AI ecosystem.

Opportunities in the Private Markets

Venture Capital

The global investment surge into artificial intelligence is unprecedented in both speed and scale. For context, venture capital (VC) invested roughly $20 billion (adjusted for inflation) into internet companies in 2000.15 This year, VCs are on course to spend over $200 billion,16 including several landmark transactions in the first half of 2025. For example, OpenAI’s $40 billion commitment from SoftBank among others and xAI’s $10 billion funding round.17

Venture capital remains the domain of big winners. If invested in a VC fund, the payoff potential is outsized – top-quartile funds have historically delivered total value-to-paid-in (TVPI) multiples of 3-4x.18

Private Equity

Private equity (PE) is an effective way to capture the diffusion of AI across the economy, and the value that can be created by the transformation of companies going through the AI revolution. Unlike venture capital, PE investors back established companies with real revenues and large customer bases.

Through PE, investors can access companies that have yet to embed AI into workflows and capture significant value creation. For PE-backed private software and AI applications companies specifically, AI powers rapid development of new products and features (like Agentic AI capabilities) unlock new revenue streams and expand margins. This stage of investment offers controlled exposure and operational leverage.

Private Credit

As AI adoption accelerates, private credit has emerged as a meaningful contributor to growth. Many private technology firms require flexible, less-dilutive capital to scale AI capabilities from data infrastructure to funding product expansion. The Cliffwater Direct Lending Index has averaged 9.5% annual returns since 2004, making it a compelling risk-adjusted vehicle for investors seeking income and downside protection.19

Infrastructure

According to McKinsey & Company, global demand for data-center capacity could almost triple by 2030, with about 70% of that demand coming from AI-workloads.20 Investing in the physical infrastructure of the AI ecosystem is an opportunity to capture growth driven by AI’s expansion, while anchored in real assets that generate steady income. The asset class also delivers more stable, contracted cash flows and portfolio diversification benefits.

AI Investment Opportunities Across Asset Classes

Risks, Adoption and Historical Parallels

We believe every technological revolution experiences valuation surge before durable expansion. While adoption is advancing at a historic pace, the trajectory of returns and where lasting value will reside remains uneven.

According to the U.S. Bureau of Labor Statistics’ Real Time Population Survey, AI adoption among consumers reached nearly 40% within two years of commercialization, faster than either the personal computer or the internet achieved comparable penetration.22

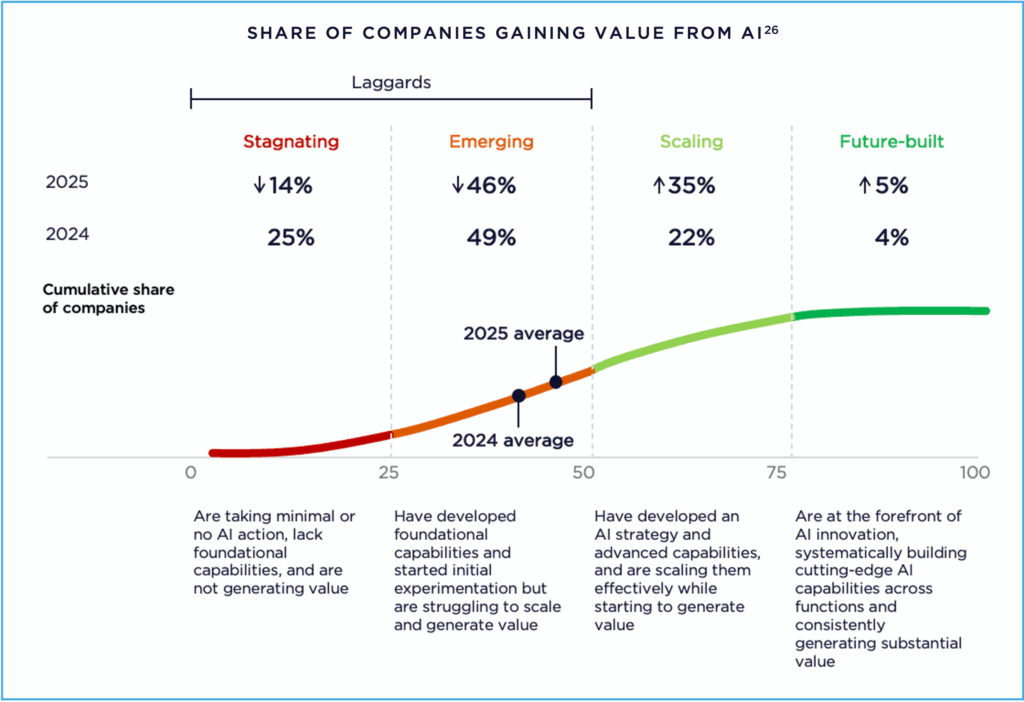

Corporate adoption is also advancing. According to a 2025 study from Wharton, 82% of the executives are using AI once a week, with 46% using it daily. In 2023, fewer than 37% said they used it once a week.24 However, while use is soaring, a BCG study shows that only 5% of companies are seeing real returns on AI, with 60% of companies seeing minimal increases in revenue and cost savings.25

This gap between technological potential and perceived value underscores a familiar pattern in innovation cycles. Some fear today’s AI environment could mirror the dot-com boom of the late 1990s, when many hyped internet businesses, from Pets.com to eToys.com, collapsed under inflated expectations.

Similarly, today’s market includes companies branding themselves as AI-native, positioned as transformative innovators, yet some offer little more than a user interface layered on top of someone else’s foundational model. Many of these companies also lack context and dominion over their data and workflows and often have consumer-like retention rates with most enterprises still in “trial / proof of concept” phase.

That parallel extends to valuations. Periods of rapid technological change can often drive exuberant pricing before fundamentals catch up. This volatility can create both distortion and opportunity.

The companies that ultimately defined the post-dot-com economy were those that paired technological vision with strong balance sheets, real customer demand and scalable business models.

We believe long-term success in AI investing may come from identifying durable enterprises positioned to translate this extraordinary technology into sustained value creation. In this environment, we believe that asset managers and investors with technology domain expertise and experience operating through significant transformations are best equipped to navigate future AI cycles with discipline.

Enterprise Software: The Center of Gravity in the AI Economy

Across every layer of the AI ecosystem one constant remains: the value of technology is only realized when it is put to work. That happens within software, where AI becomes embedded into the daily operating systems of business.

We believe enterprise software represents the most durable conduit for AI-driven value creation. These companies translate the power of AI infrastructure and models into products that enhance productivity, automate workflows and deliver measurable outcomes for end users. As AI adoption matures, we believe the software layer will increasingly serve as the commercial interface between innovation and the economy at large.

Software’s centrality rests on five structural advantages:

- Proprietary Data: Enterprise software platforms sit atop vast stores of operational and customer data, much of it proprietary and non-public. This data becomes a critical input for developing AI models and applications that competitors cannot easily replicate.

- Understanding Business Workflows: Software vendors know where humans are spending time and how business process are architected, which provides a clear ‘jobs-to-be-done’ roadmap for where to deploy AI agents.

- Direct Customer Relationships: Software providers have trusted relationships with end users established over years. This incumbency provides a critical entry point for AI adoption. Additionally, this proximity to customers may enable rapid feedback loops for targeted innovation.

- Established Distribution Infrastructure: Many enterprise software firms already have the delivery infrastructure to deploy new AI capabilities at scale, which we believe can accelerate monetization and adoption.

- Quantifiable ROI: AI-powered software can generate tangible financial outcomes: cost savings, revenue uplift, and productivity gains. This measurable return can make it easier for enterprises to justify continued investment and integration.

Final Thoughts

Morgan Stanley estimates that AI adoption in the U.S. could generate nearly $1 trillion in annual economic gains, with roughly half coming from Agentic AI, software capable of performing complex tasks with minimal human oversight.27

The competitive differentiator for these companies is likely to increasingly hinge on data sovereignty and model defensibility. Software firms that combine data control with domain expertise and scalable distribution can define the next era of enterprise value creation.

In the same way that the internet redefined the previous decade of innovation, enterprise software is poised to anchor the AI decade ahead. For investors, understanding this layer, where technology becomes productivity and adoption becomes return, may be critical to capturing the potential long-term value of the AI economy.

Download the White Paper

Powering Innovation Across the Portfolio: How Vista’s Hackathons Advance AI and Enterprise Software

Driving Innovation Across the Software Ecosystem