Rethinking Software Benchmarks in an AI-Driven Market

How the Rule of 40 could become Rule of 60+

Artificial intelligence (AI) is speeding up innovation across the software industry and changing the way companies grow. AI now influences how products are built, how quickly they reach customers and how efficiently companies operate. Because of this, we believe the definition of “strong performance” is starting to change, and investors and executives are revisiting the metrics that have shaped software valuation for years.

This paper explains what’s driving that change. It begins with the basics – how software businesses create value and how that value is typically measured – before exploring why those benchmarks are shifting in today’s AI-driven environment.

Understanding What Drives Value in Software

Software businesses work differently from most other companies. Once a product is built, it can be sold again with incremental additional cost, which allows software providers to scale quickly and capture more of the economic value through high margins. Many software products are also mission-critical whereby customers rely on them to run core parts of their operations. That makes switching to a new system difficult and expensive. As a result, software companies tend to have high retention and long customer relationships.

Investors typically assess software companies across several dimensions:

- Growth and profitability: the pace of expansion and the quality of earnings including metrics like annual recurring revenue (ARR) and gross margin.

- Unit economics and capital efficiency: how efficiently the business acquires and retains customers including metrics like gross retention, net retention and lost-only retention.

- Product superiority: depth and breadth of functionality relative to competitors including metrics like adoption rates and time to value.

- Market attractiveness: size and growth of the addressable market including metrics like total addressable market and market penetration.

- Operational scalability: the company’s ability to grow without proportionally increasing cost including metrics like revenue per employee.

- Strategic and qualitative differentiators: unique capabilities, domain depth, ecosystems and leadership.

Within this broader evaluation framework, one shorthand metric has historically been used to understand the balance between growth and profitability: the Rule of 40.

Why the Rule of 40 Became a Benchmark

The Rule of 40 adds a company’s annual revenue growth rate to its profit margin. If the combined number reaches 40% or greater, the company is generally considered to be healthy. For example, a company growing 30% with a 15% profit margin is a Rule of 45 company.

Its appeal lies in its simplicity. The Rule of 40 can be applied to companies of different sizes and maturity levels: younger companies may grow quickly with thin margins, while more mature firms may deliver stable margins with steadier growth. Both can be value-creating. The Rule of 40 helps investors compare these different profiles on a common scale.

That said, it is one indicator among many. It does not replace detailed analysis of revenue retention, gross margins, sales efficiency or customer lifetime value. But as a directional gauge, it has been widely used to evaluate whether a software business is compounding value sustainably.

Why Expectations Are Shifting: Introducing the Rule of 60

What is the Rule of 60?

The Rule of 60 is an emerging performance benchmark suggesting that AI-enabled software companies can achieve a combined growth rate and profit margin of 60% or more.

Technology cycles periodically redefine what strong performance looks like in software.

The migration of the software tech stack from on-premise to cloud is a recent example: it freed up companies operating costs to enable higher margins and greater efficiency to market, which raised the bar for what “good” performance could look like.

We are now in another one of those periods. Advances in artificial intelligence, particularly generative AI (Gen AI) and agentic AI, are changing how software is developed, delivered and adopted. We believe these capabilities can accelerate product innovation, enable new business models, expand market reach and improve operational efficiency.

As a result, the growth–profitability frontier is shifting. Companies that successfully integrate AI into their products and operating models have the potential to grow faster and scale more efficiently than was previously possible. That expanded frontier suggests a new performance benchmark, one where the combination of growth and profitability could reach 60% or more.

It is important to emphasize that this is an emerging aspiration, not a universal baseline. Today, relatively few companies operate at this level. But the direction of travel is clear: software businesses that harness AI effectively may be positioned to reach higher levels of value creation than the traditional Rule of 40 captures.

How AI Expands the Growth–Profitability Frontier

AI is reshaping the economics of software through two reinforcing effects: it is accelerating revenue growth while also improving cost efficiency and scalability.

How AI Can Accelerate Revenue Growth

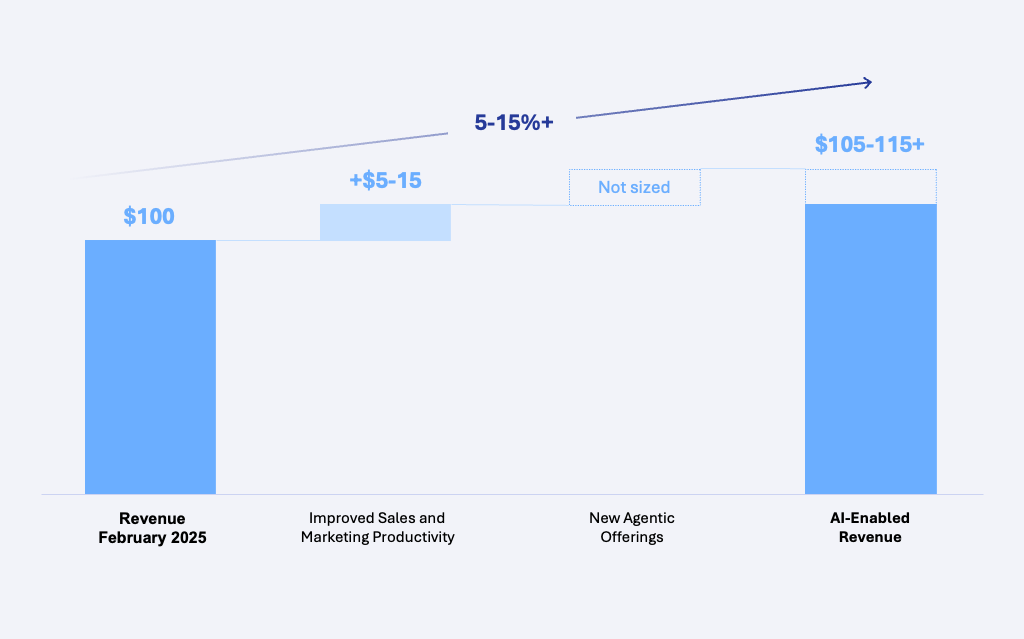

Illustrative Revenue Impact from AI Implementation1

Faster Product Innovation and Feature Velocity

Software development has long been limited by the availability and cost of specialized engineering talent. Generative AI and code-assist tools help teams prototype, test and refine features much more quickly. This shortens development cycles, speeds time-to-market and allows companies to respond to customer needs more dynamically. Over time, this continuous improvement strengthens product competitiveness and can increase net retention as customers receive more value without waiting for large, infrequent releases.

Expansion of the Total Addressable Market

Historically, entering new markets or building adjacent product lines required significant investment or multi-year rebuilds. AI can reduce the time and cost needed to create new modules, workflows or product extensions. Companies can now test new ideas faster and expand into adjacent use cases with less incremental costs. This enables growth to come not only from acquiring more customers, but also from launching new revenue streams.

According to a survey from Bain, leveraging generative AI can save up to 30% in total software engineering time, when AI is leveraged effectively.2

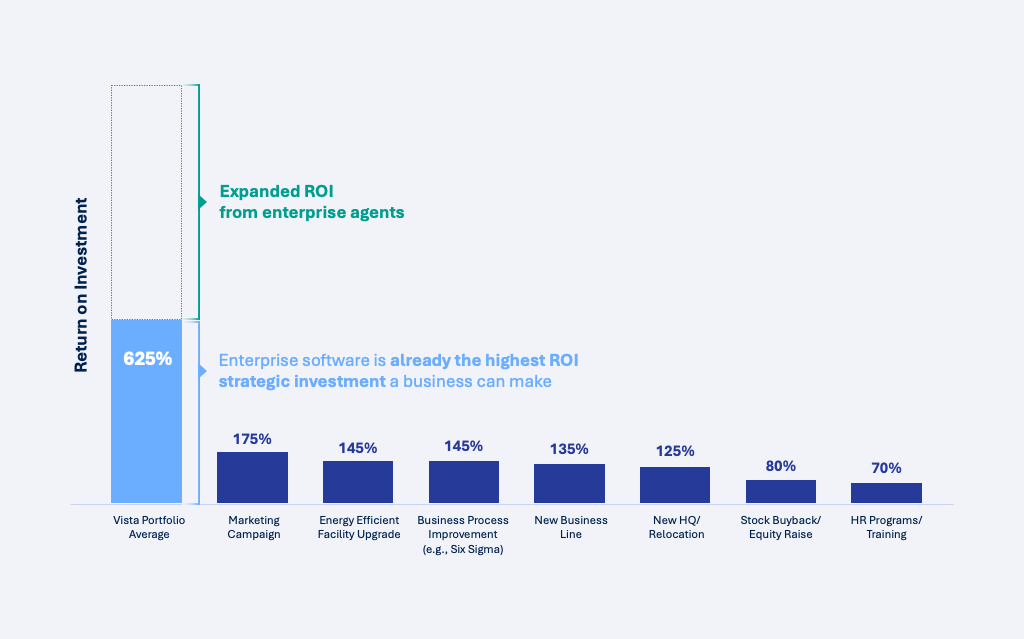

Embedded Intelligence and Value-Based Pricing

Traditional software often requires users to analyze data and determine next steps on their own. AI-enhanced products can recommend actions – or automate them – directly within the workflow. This helps shift software from being a “system of record” to a “system of outcomes.” Enterprise software can already provide significant return on investment (ROI) as a strategic investment. This ROI is compounded with AI and when the value delivered becomes more visible and measurable, companies can justify premium pricing and drive higher net revenue retention.

Return on Investment from Strategic Business Investments3

How AI Improves Cost Efficiency and Scalability

Illustrative Cost Impact from AI Implementation4

Greater Efficiency Across Product, Engineering, and Customer Operations

AI is reshaping the operating cost structure inside software businesses. Engineering teams can produce more output per developer. Customer onboarding, support and services can use intelligent automation to reduce manual work and accelerate cycle times. These improvements allow companies to serve more customers without proportionally increasing headcount, strengthening margins while maintaining product quality and customer experience.

More Precise and Scalable Go-to-Market Execution

AI is also transforming sales and marketing. While in the past, sales teams only spent a portion of their time on sales efforts due to manual administration work, today that time can be significantly reduced thanks to AI. In addition to improving targeting through traditional machine-learning models, newer generative and agentic AI tools help sales teams scale their outbound efforts by automating personalized messaging, drafting outreach, and even supporting guided calling workflows. These capabilities raise pipeline quality, reduce manual effort, and help teams focus on the opportunities most likely to move forward. As a result, companies can grow more efficiently without expanding sales coverage at the same pace, making customer acquisition less resource-intensive and more predictable.

Taken together, these forces represent a meaningful evolution in software economics. Companies can grow faster and do so with better operating leverage. This upward shift in both growth and profitability is the underlying logic of the emerging Rule of 60: a recognition that, for companies that incorporate AI effectively, the performance frontier has moved.

The Shift in Pricing and Packaging

We believe the economics of software is undergoing a fundamental shift. Because agentic software can perform the work of multiple humans, we believe the “per-seat” metric is becoming obsolete. Instead, the focus is shifting toward work-based units and value-realization. Future pricing strategies could center on:

- Outcome-based pricing: charging strictly for successful results, such as a qualified lead generated or a customer issue resolved.

- The digital worker (per-agent) model: positioning software as an “automated full-time employee” with a flat fee per autonomous agent deployed, aligning the cost directly with HR or outsourcing budgets.

- Consumption-based logic: charging for the compute and effort expended – such as credits per task or tokens per reasoning step – to protect margins on complex, multi-step agentic loops.

- Hybrid models: a combination of a base platform fee for security and governance, coupled with variable success fees to capture the upside of the value created.

Conclusion: A Higher Performance Frontier

AI is expanding the range of what’s possible in software. It is accelerating product innovation, enabling market expansion and improving operational scalability. For companies that harness these capabilities effectively, the balance between growth and profitability can rise – making the Rule of 60 an emerging benchmark for high-performance software businesses.

Not every company will reach this level. But we believe those that do will pair AI adoption with disciplined prioritization, strong data foundations, operational enablement, and a clear focus on customer value. As the market continues to evolve, we believe these will be the characteristics that distinguish the next generation of category leaders.

Agentic AI Is Here – What Investors Need to Know

AI Investment Landscape Primer